Introduction: A Need for Digital Financial Efficiency

While the travel industry has embraced digital transformation in customer experiences — from online bookings to real-time itinerary management — its B2B backend has remained surprisingly outdated. Payment settlements between travel agents, suppliers, and service providers are often delayed, manually processed, and error-prone.

In response to this longstanding inefficiency, Travel Ledger’s integration with Revolut marks a significant milestone. By embedding Revolut’s real-time payment capabilities into the Travel Ledger ecosystem, businesses across the travel supply chain can now transact faster, more transparently, and more securely.

Why B2B Travel Payments Were Broken

The traditional B2B payment process in travel involves multiple intermediaries, currencies, and timing gaps. This leads to a host of problems such as:

Delayed Settlements: Cross-border bank transfers can take 2–5 business days.

Manual Reconciliation: High dependency on spreadsheets and emails for tracking payments.

Currency Conversion Inefficiencies: Added costs and lack of transparency in foreign exchange rates.

Disputes and Errors: Human errors in invoicing and matching cause operational friction.

These bottlenecks not only slow down transactions but erode trust between buyers and suppliers.

How Travel Ledger + Revolut Solves the Problem

The new integration allows businesses to manage and execute payments directly within Travel Ledger, using Revolut’s multi-currency business accounts and API-driven automation.

Key benefits include:

✅ Instant Transfers: Domestic and international payments are completed in seconds, not days.

🌍 Transparent FX Rates: No hidden fees or inflated conversion charges.

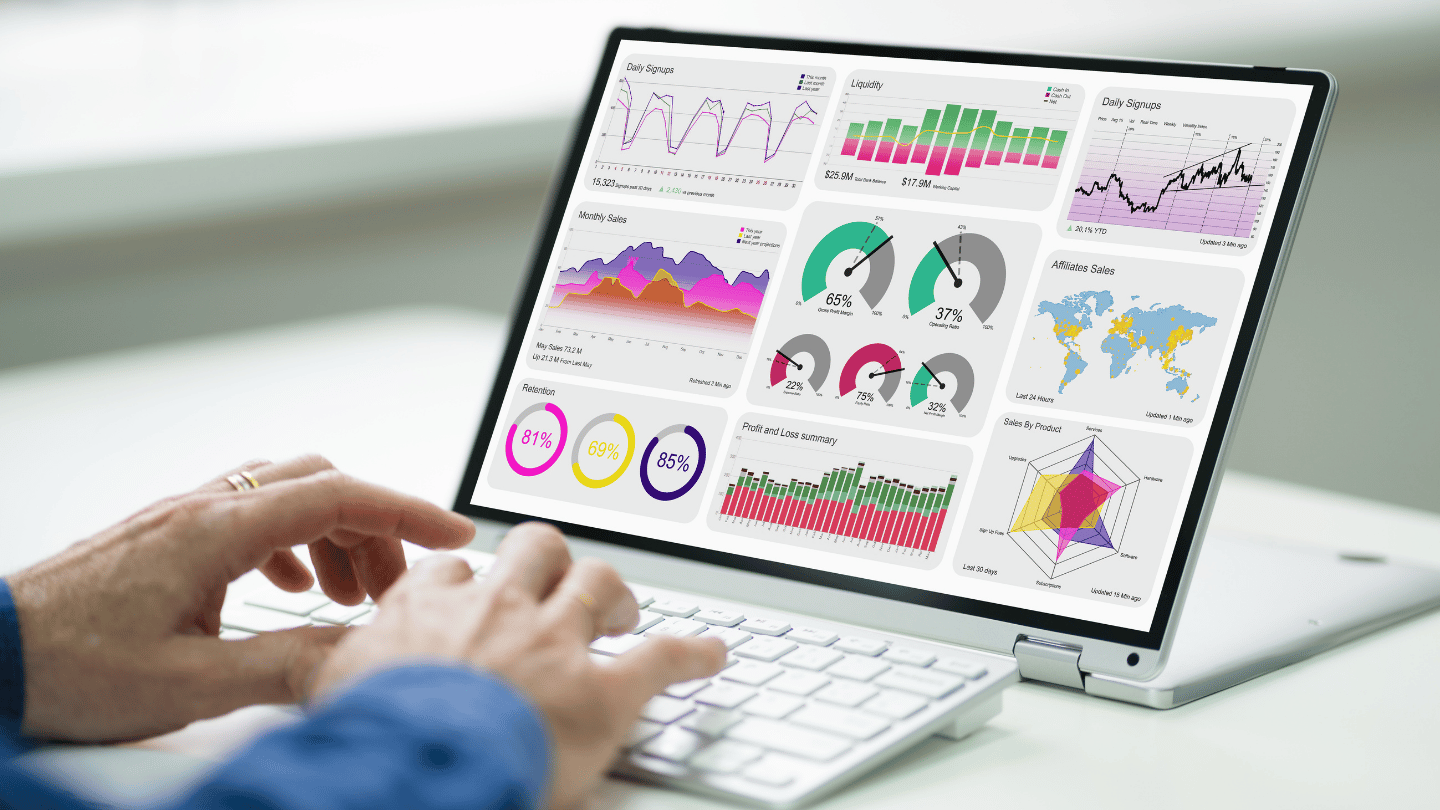

🧾 Real-Time Reconciliation: Invoices are matched automatically as payments are processed.

🔐 Built-In Security & Compliance: PSD2-compliant protocols reduce fraud risk.

This allows travel companies to focus more on growth and service, and less on chasing payments and paperwork.

Why It Matters for the Travel Supply Chain

In an industry built on interdependence, smoother B2B payments can lead to:

🚀 Faster booking confirmations and turnaround times

💼 Improved supplier relationships and trust

📉 Reduction in financial disputes and reconciliation time

📊 Better cash flow management for all parties

Imagine a tour operator in the UK instantly settling a payment with a hotel group in Thailand — without delays, FX surprises, or reconciliation hassles. That’s the operational efficiency this integration brings to the table.

Conclusion: A Step Toward Travel Fintech Maturity

This integration is more than a feature — it’s part of a broader fintech movement reshaping how the travel industry operates behind the scenes. As platforms like Travel Ledger embed fintech partners like Revolut into their workflows, the travel sector is entering an era of real-time, automated B2B commerce.

For travel companies looking to scale efficiently in a post-pandemic world, embracing this kind of financial infrastructure isn’t optional — it’s essential.